18.03.2024

Danske Commodities employee recognised as top talent in Denmark

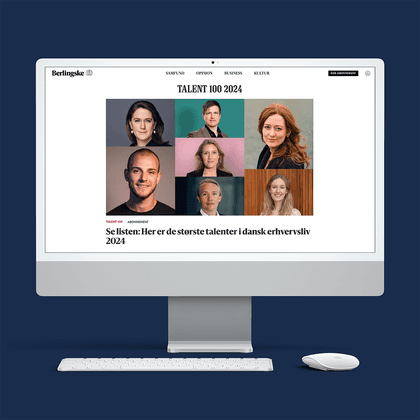

Sidsel Andersen Risager, head of HR Partnering & Development in Danske Commodities, is honoured as one of Denmark’s most promising business talents this year and has earned a spot on the prestigious Talent 100 list, published by Danish news media Berlingske. During her four years at Danske Commodities, Sidsel has played a crucial role in making gender diversity a priority, and thanks to her, the company’s job adverts are now written in a neutral language and all candidates are anonymised during the initial screening. Besides, Sidsel has paved the way for Danske Commodities to offer part-time work options and ensuring employees can take sick days to care for their children whenever they need.